Accelerated Rates of Return Floor & Decor Holdings (NYSE:FND) Leave Little Room for Happiness.

To find more stock-baggers, which of the following should we look for in business? First, we will want to see what is proven come back with the capital employed (ROCE) increasing, and secondly, is to grow the foundation of money spent. If you see this, it usually means that it is a company with a good business model and many opportunities to make good profits. However, when we look Floor & Decor Holdings (NYSE:FND), didn’t seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you’re not sure, ROCE is a metric that measures how much pre-tax income (in percentage) a company earns on the money invested in its business. To calculate this metric for Floor & Decor Holdings, here is the formula:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

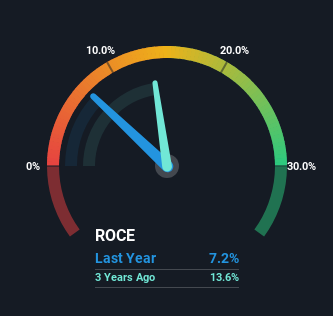

0.072 = US$265m ÷ (US$4.8b – US$1.1b) (Based on the next twelve months to June 2024).

Therefore, Floor & Decor Holdings is about 7.2%. Ultimately, that’s a low and underperforming Specialty Retail industry margin of 12%.

Get a full review of the name Floor & Decor Holdings

Above you can see how Floor & Decor Holdings’ current ROCE compares to its previous returns on capital, but there’s only so much you can tell from the past. If you’d like, you can check out the predictions from analysts about Floor & Decor Holdings for for free.

The ROCE Method

There are better cash flows than we see at Floor & Decor Holdings. Over the past five years, ROCE has remained flat at around 7.2% and the business has posted a 131% profit in its operations. Since the company has increased the amount of working capital, it appears that the investment made does not provide a high return on capital.

The Bottom Line On Floor & Decor Holdings’ ROCE

Finally, Floor & Decor Holdings is investing a lot of money in the business, but the return on that investment is not increasing. Investors must be thinking there are better things to come because the stock has knocked it out of the park, delivering a 128% return to shareholders over the past five years. However, unless these basic trends change for the better, we cannot raise our confidence.

Floor & Decor Holdings may sell at attractive prices in other ways, so you can find ours FND free value estimate Our platform is very important.

If you want to look for solid companies with great paychecks, check this out for free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are price sensitive or quality materials. Simply Wall St has no position in the stocks mentioned.

#Accelerated #Rates #Return #Floor #Decor #Holdings #NYSEFND #Leave #Room #Happiness