Capri-Tapestry Convention Closed. What Should Investors Do With Stocks? | The Motley Fool

In a surprise move, a judge ruled in favor of the US government and blocked a proposed merger between the handbag and fashion rivals. Features of Capri Holdings (CPRI -2.95%) and Tapestry (TPR -0.49%). The Federal Trade Commission (FTC) filed to block the merger in April after Tapestry agreed to buy Capri last year, arguing that the combination would hurt consumers and leave fewer bag options. .

The FTC’s case was considered too long, as there was little to prevent deals in the fashion industry and it would be difficult to prove that the deal would hurt consumers or increase prices. .

Michael Kors’ Capri brand and Coach’s Tapestry, meanwhile, are considered high-end brands available. On its website, Coach has handbags up to $10,000, while Kors has bags around $3,300, so it doesn’t sell cheap goods.

The news sent Capri stock tumbling, as its shares fell more than 45% while Tapestry shares doubled. Now that the rally has closed, what should investors do with the stock?

Capri

Capri, home to luxury brands Versace and Jimmy Choo, in addition to Kors, has struggled since the merger announcement. Therefore, the decline in its shares should probably not come as a complete surprise to us.

The company has seen its revenue decline for seven straight quarters, including a 13% decline in the last quarter, which ended in June. Kors is the biggest brand and sales are down 14%, and down more than 20% in Europe and Asia. The brand’s operating income fell by 42%.

Things were no better for Versace, which saw its sales drop by 15%. Europe was its weakest region, with sales down 22%, while sales in America fell 15%. Asia only saw a 3% drop in sales.

Jimmy Choo, known for women’s shoes, was Capri’s best-performing brand, but sales were down 5.5%. The company saw good sales in the US, but Asia was a weak area, with revenue down 17%.

Capri has been in turmoil for the past year while waiting for its stock to arrive, so it’s no surprise that its performance has been low. Typically, managers won’t make big changes before they’re bought out, while uncertainty can affect company morale and lead to a drain on talent.

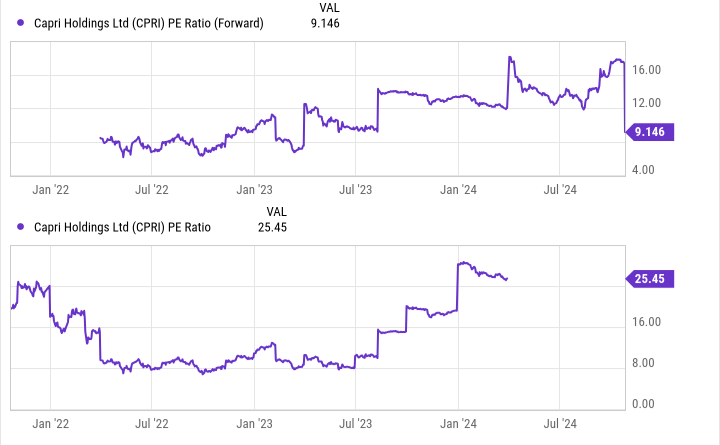

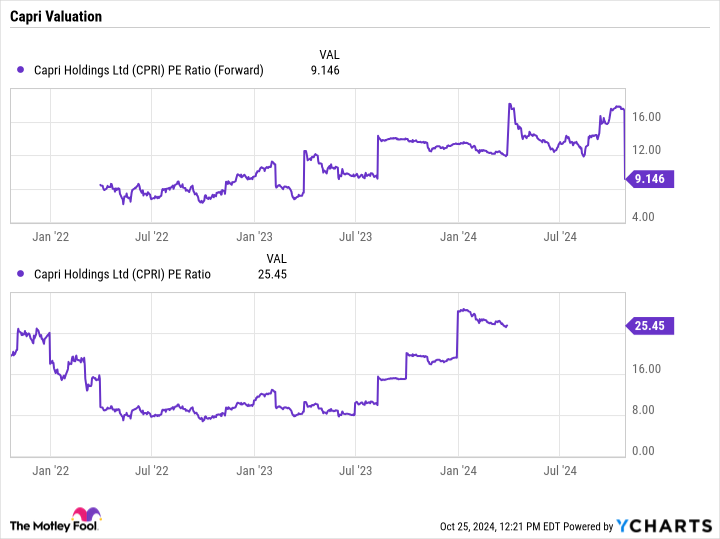

From a value point of view, the deterioration of shares lowers the original Capri-to-earnings ratio (P/E) to 9. However, it is slightly higher than where the stock is sold before purchase announcement.

CPRI PE Ratio (Forward) data by YCharts.

Meanwhile, investors are left with a company that underperformed last year and now has to start a turnaround. Although the company should see a renewed focus, the damage has been done and the transition may not be easy. Even if it went down a lot, I would stay away from the stock.

Image source: Getty Images

Tapestry

Preventing the government from dealing with Capri could be the best thing for Tapestry. The company will have to pay Capri up to $50 million if the deal is rejected, but that’s a small price to pay.

Meanwhile, Tapestry, which is owned by Coach, Kate Spade and Stuart Weitzman, is doing better than Capri. While its sales fell 2% last quarter, it was flat on a consistent basis. Meanwhile, its adjusted earnings per share (EPS) fell from $0.95 to $0.92.

In addition to being Tapestry’s largest brand, Coach continues to perform best, with sales up 2% in Q4 revenue and 4% year-over-year. Kate Spade and Stuart Weitzman, meanwhile, both saw sales fall last quarter and the entire year.

Overall, Tapestry saw solid growth in Europe, which appears to have been Capri’s weakest market, while North American sales were down slightly. Asia (excluding China) saw solid growth, although sales in China last quarter were down 10%.

The company expects moderate revenue growth in 2025 with a small network upgrade. It had previously said that if the Capri takeover didn’t work out, it would use its strong cash flow for cash distributions, mainly to buy back shares.

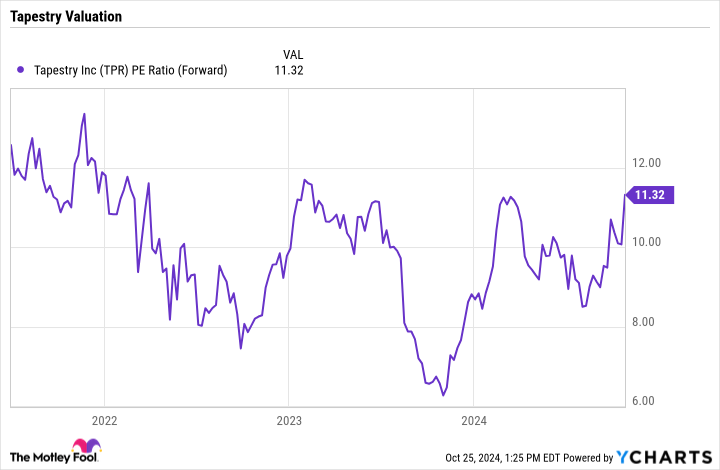

Trading at a forward P/E of 11, Tapestry is close to trading at levels ahead of the merger announcement.

TPR PE Ratio (Excess) data by YCharts.

While the company has outperformed Capri, it has not been a strong grower, as sales have not changed much over the past two financial years. The company must now look for another way to renew growth. Due to its lack of growth and jump in stock price, the stock currently looks very valuable.

#CapriTapestry #Convention #Closed #Investors #Stocks #Motley #Fool